- Home

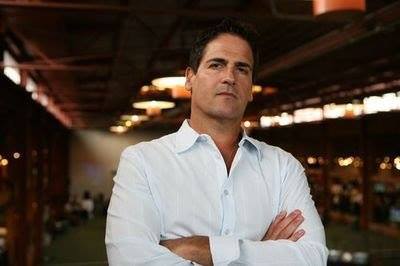

- Marc Cuban Wealth Masterclass

Marc Cuban: Masterclass

of a Serial Killer-Investor

Marc Cuban, the billionaire entrepreneur, investor, and owner of the NBA's Dallas Mavericks, is an inspiring figure in the world of wealth-building.

From his humble beginnings as a broke college student to becoming one of the wealthiest individuals in the world, Cuban's story is a masterclass in entrepreneurship, investing, and smart decision-making.

Disclosure: We recommend products we believe to be suited for our own use and for our readers. We may earn a small commission at no additional cost to you through purchases made via affiliate links on this page.

His journey offers valuable lessons for anyone seeking to build wealth, with insights into risk-taking, identifying opportunities, and leveraging knowledge for success.

Let’s dissect Cuban’s path to riches and highlight key strategies that can be applied to anyone’s personal financial journey.

1. The Humble Beginnings: Starting from Scratch

Marc Cuban’s story begins in the steel town of Pittsburgh, Pennsylvania, where he was born in 1958. Growing up in a working-class family, Cuban learned early on the value of hard work.

His father was a car upholsterer, and his mother worked in a

variety of jobs. However, Cuban's drive for success led him to set his sights

higher than most of his peers.

In college at Indiana University, Cuban was far from wealthy. He was a typical

broke college student, hustling to make ends meet.

Cuban worked various jobs, from selling garbage bags door-to-door to teaching disco lessons.

His time in college helped him develop a sense of how to

seize opportunities in unconventional ways—lessons that would shape his career

later on.

Cuban’s story begins with an essential wealth-building principle: hustle

and perseverance. He didn’t wait for opportunities to come to him;

instead, he created them.

Whether it was selling items or networking with the right people, Cuban started with a mindset of resourcefulness and determination.

2. The First Big Move: The Tech Startup Boom

After college, Marc Cuban moved to Dallas, where he started working in the tech industry. In 1990, he co-founded MicroSolutions, a computer consulting company.

Cuban was not initially wealthy, but he had a natural

aptitude for sales and technology, which positioned him to recognize

opportunities in the booming tech sector.

MicroSolutions was a success, but the real game-changer came when Cuban decided

to sell the company in 1990 for $6 million. This move provided him with his

first significant financial windfall and an opportunity to make bigger moves.

Cuban’s experience with MicroSolutions showed that entrepreneurship and

business acumen are foundational to wealth-building.

Even in the early stages of his career, he was keenly aware of the importance of taking calculated risks and pursuing opportunities that others may overlook.

He was also able to identify valuable niches—his first company catered to businesses that needed to set up computer systems at a time when personal computing was still in its early stages.

3. The Billion-Dollar Idea: Broadcast.com and the Internet Revolution

Marc Cuban’s real wealth-building breakthrough came in the mid-1990s. After selling MicroSolutions, Cuban became involved with a new venture: Broadcast.com.

Cuban and his business partner, Todd Wagner, launched Broadcast.com as a platform to stream audio and video over the internet—an idea ahead of its time.

At a time when the internet was still in its infancy, Cuban

saw an opportunity to disrupt traditional broadcasting by leveraging the web.

Broadcast.com was one of the first companies to capitalize on the idea of

streaming content over the internet, and it quickly gained traction.

In 1999, Cuban took Broadcast.com public in a highly

successful IPO. By 2000, the company was acquired by Yahoo! for $5.7

billion in stock. Cuban’s personal take from the deal was around $2

billion.

The Broadcast.com success story illustrates several key wealth-building

principles:

- Innovating early: Cuban capitalized on a new and emerging technology (the

internet) before it reached mainstream adoption.

- Risk taking: Cuban didn’t shy away from taking bold bets, like investing in a niche market that was unproven at the time.

- Scalability: The platform Cuban built with Broadcast.com was scalable, able to reach a massive audience through the internet. Recognizing the scalability of an idea is crucial for wealth-building.

4. Lessons Learned from the Broadcast.com Exit

While the sale of Broadcast.com catapulted Cuban into the billionaire ranks, it was not just the windfall that made him financially successful—it was his ability to recognize the potential for massive growth and seize the moment.

Cuban has been open about the fact that he was lucky to be

at the right place at the right time, but he always emphasizes

that luck is when preparation meets opportunity.

Cuban also learned valuable lessons from the sale. For instance, he realized

that an exit should be structured wisely to maximize wealth.

The deal with Yahoo! was in stock, not cash, and Cuban made it a point to retain enough control and keep enough equity in his businesses after the sale to ensure his continued success.

5. Diverse Investments: Spreading the Risk

After his big payday from Broadcast.com, Cuban could have easily coasted, but instead, he aggressively expanded his investment portfolio.

Cuban is known for his diversified investment strategy.

Beyond his ownership of the Dallas Mavericks, Cuban has invested in a variety

of businesses across industries, including technology, health, and

entertainment.

For example, he made early investments in companies

like Alibaba, Netflix, and Uber—all of which would go on to be

major players in their respective industries.

Cuban's investment strategy emphasizes the importance of finding early-stage opportunities, as well as staying diversified and avoiding putting all of one’s eggs in a single basket.

6. The Dallas Mavericks: Building Wealth Beyond Tech

In 2000, Cuban made a bold and highly publicized purchase: he bought the Dallas Mavericks for $285 million.

At the time, the team was struggling financially, but Cuban saw an opportunity to turn it around by injecting capital, introducing better management practices, and connecting with fans in innovative ways.

Fast forward to 2024, the Dallas Mavericks have seen their value

continuously rise to a current worth of $4.7 billion, under Cuban’s leadership.

This venture illustrates another key wealth-building principle: business

turnaround and management expertise.

Cuban didn’t simply buy an existing asset; he improved it and maximized its potential, proving that sometimes, even established businesses can offer huge returns if the right person is in charge.

He is out to prove it again with his Cost Plus Drugs initiative in the pharmacy sphere with generally positive early reviews.

7. The Mindset of a Billionaire: Strategic Thinking and Continuous Learning

Beyond his specific investments and entrepreneurial ventures, Cuban’s mindset is what truly sets him apart.

He advocates for constant self-improvement and staying ahead

of the curve. Cuban is a voracious reader, constantly consuming knowledge on a

wide range of topics, from technology to psychology.

He has often stated that his success is attributed not just to his financial

moves but also to his ability to learn quickly, adapt to changing

circumstances, and think strategically.

His advice to aspiring entrepreneurs is clear: never stop learning, and always seek out opportunities for growth.

In Closing: The Wealth-Building

Formula of Marc Cuban

Marc Cuban’s journey from a broke college student to a billionaire offers a blueprint for wealth-building that anyone can learn from. While the specifics of his investments and ventures may be unique to him, the principles he employed are universally applicable:

- Hustle and perseverance: Create your own opportunities and work hard to make

them happen.

- Take calculated risks: Don’t shy away from the unknown—seize opportunities even

when they seem unconventional.

- Innovate early and stay ahead of trends: Be the one to recognize new technologies or industries and capitalize on them.

- Diversify your investments: Don’t put all your money into one venture—spread your risk across different opportunities.

Think strategically and continuously improve: Always be learning and improving,

so you can make smarter decisions in your wealth-building journey.

Marc Cuban’s success is not just about making money—it’s about creating value,

seizing opportunities, and managing risks in a way that multiplies wealth.

With the right mindset and strategies, adherents can follow in his footsteps and start building their own financial legacy.

Start Making Money

with Affiliate Marketing!

Quality Affiliate Programs

Recent Articles

-

Personal Finance Tips: Your Financial North Star

Personal finance tips on how a financial North Star can help you be more successful. -

The Ashton Kutcher Net Worth Story

How the Ashton Kutcher net worth of today defines his comeback kid story. -

Is Selena Gomez A Billionaire? How So?

Is Selena Gomez a billionaire? Learn how she has earned her money and lessons you can use to increase your own wealth.